Our Impact in 2025

This year, as Lendistry looked back on its first 10 years of impact, I did my best to appreciate the moment even though I can’t help looking ahead to the next ten years, the next barrier to break. I am by nature impatient for every step toward an ecosystem in which entrepreneurs can strive for opportunities with confidence, knowing responsible, innovative capital will be available when they’re ready.

This year, as Lendistry looked back on its first 10 years of impact, I did my best to appreciate the moment even though I can’t help looking ahead to the next ten years, the next barrier to break. I am by nature impatient for every step toward an ecosystem in which entrepreneurs can strive for opportunities with confidence, knowing responsible, innovative capital will be available when they’re ready.

For the past decade and in 2025, we have stayed grounded in our mission. When uncertainty arose, we said “yes” and went all-in for the small businesses we founded Lendistry to support—with partners who share our vision.

This year we have welcomed new capital partners, won recognition, increased our visibility in the women’s sports world, and most importantly, provided transformative capital for businesses nationwide. We even entered an entirely new industry—again.

I encourage you to learn about what we’ve been doing and do what’s in your power to support the small businesses that nourish our communities.

Everett K. Sands, CEO

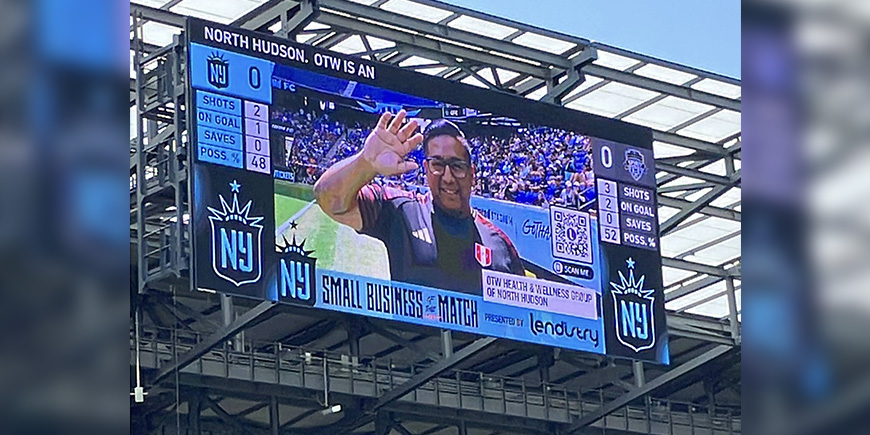

Photos from top to bottom: Toasting 10 years with fellow leaders at Lendistry Gala, LA Area Chamber Corporate Leadership Award, Orange County Hispanic Chamber of Commerce Community Impact Award, Filming Lendistry commercial with Azura Stevens, Appearance on The Chavis Chronicles, LA Sparks Partner Dinner with Magic Johnson, Asian Business Association of LA (ABALA) Advocate of the Year Award, Tossing T-shirts at Lendistry night with Gotham Football Club

Our 10th Anniversary Celebration

10 Years of Evolution

2015-2017

- Lendistry Launched

- Certified as a CDFI by U.S. Treasury

- Received approval for Small Business Administration ("SBA") Community Advantage Program

2018-2020

- Admitted to FHLB

- Launched proprietary origination platform

- Opened LA office in Opportunity Zone

- Certified as a CDE by U.S. Treasury

- Focused on deploying PPP loans

- Selected to administer Pennsylvania Grant Program

2021

- Selected to administer first California COVID-19 Small Business Relief Grant Program

- Approved to originate PPP loans in all 50 states

- Selected to administer New York State and New York City Grant Programs

2022

- Received SBA Small Business Lending Company license, created Lendistry SBLC entity

- Received $35 million in New Markets Tax Credits allocation

- Opened Baltimore, Dallas, NYC, San Jose, Tustin office locations

2023

- Lendistry SBLC received SBA Preferred Lender status

- Opened internal Customer Experience (Call) Center in Tustin

- Selected to administer Illinois State grant program

- Approved more SBA 7(a) loans than any other Black-led institution

2024

- Milestone of $10 billion in total loans and grants distributed to small businesses

- Becomes Official Small Business Lender of the LA Sparks WNBA team

- CEO Everett K. Sands named as Greater Los Angeles Entrepreneur of the Year and one of the LA 500

- Lendistry Home Loans launched

2025

- Administers two grant programs for LA Wildfire Recovery

- Ranks among the top ten SBA 7(a) lenders by number of loans

- Receives the Los Angeles Area Chamber of Commerce Corporate Leadership Award

- Earns recognition as one of American Banker’s Best Places to Work in Fintech

- Becomes Official Small Business Lender of the Gotham Football Club NWSL team

- Begins partnership with Walmart Seller Marketplace

- Lendistry Insurance Fulfillment Team launched

10 Years of Evolution

2015-2017

- Lendistry Launched

- Certified as a CDFI by U.S. Treasury

- Received approval for Small Business Administration ("SBA") Community Advantage Program

2018-2020

- Admitted to FHLB

- Launched proprietary origination platform

- Opened LA office in Opportunity Zone

- Certified as a CDE by U.S. Treasury

- Focused on deploying PPP loans

- Selected to administer Pennsylvania Grant Program

2021

- Selected to administer first California COVID-19 Small Business Relief Grant Program

- Approved to originate PPP loans in all 50 states

- Selected to administer New York State and New York City Grant Programs

2022

- Received SBA Small Business Lending Company license, created Lendistry SBLC entity1

- Received $35 million in New Markets Tax Credits allocation

- Opened Baltimore, Dallas, NYC, San Jose, Tustin office locations

2023

- Lendistry SBLC received SBA Preferred Lender status

- Opened internal Customer Experience (Call) Center in Tustin

- Selected to administer Illinois State grant program

- Approved more SBA 7(a) loans than any other Black-led institution

2024

- Milestone of $10 billion in total loans and grants distributed to small businesses

- Becomes Official Small Business Lender of the LA Sparks WNBA team

- CEO Everett K. Sands named as Greater Los Angeles Entrepreneur of the Year and one of the LA 500

- Lendistry Home Loans launched

2025

- Administers two grant programs for LA Wildfire Recovery

- Ranks among the top ten SBA 7(a) lenders by number of loans

- Receives the Los Angeles Area Chamber of Commerce Corporate Leadership Award

- Earns recognition as one of American Banker’s Best Places to Work in Fintech

- Becomes Official Small Business Lender of the Gotham Football Club NWSL team

- Begins partnership with Walmart Seller Marketplace

- Lendistry Insurance Fulfillment Team launched

Stepping Up for Small Businesses Affected by January’s LA Wildfires

- 1,863 small businesses located in burn zones

- 9,610 people employed at affected businesses

- 43.9% of commercial buildings destroyed, Palisades

- 36.3% of commercial buildings destroyed, Eaton

- Source: https://laedc.org/research/reports/impact-of-2025-los-angeles-wildfires-and-comparative-study

With The Center by Lendistry serving as the primary administrator and Lendistry providing its grant deployment platform, the LA County Household Relief Grant Program launched in February to provide grants to households affected by the wildfires. The program was offered by LA County’s Department of Consumer & Business Affairs.

Soon after, the Los Angeles Area Chamber of Commerce selected Lendistry to administer its Disaster Recovery Fund (DRF), supporting small businesses with grants to help them recover, rehire, and reopen. This program is ongoing with multiple rounds of funding.

Small Business Unscripted: A New Podcast from Lendistry

Lendistry congratulates Gotham FC on their 2025 NWSL Championship!

The New Official Small Business Lender of Gotham Football Club

To celebrate our latest women’s sports sponsorship, we launched a Small Business City campaign celebrating businesses in NY and NJ. Throughout the 2025 season, Lendistry customers were shouted out on our social media and invited to be Small Business of the Match at home games.

Our impact in New York & New Jersey since 2015

Loans

Businesses

Another Year Celebrating Small Businesses with the Los Angeles Sparks

In 2025, WNBA Champion Azurá Stevens became Lendistry’s first brand ambassador!

Our impact in Los Angeles County since 2015

Loans

Businesses

Photo: Joe Kerwin, Lendistry CMO; Carol Podolak, BNutty, Portage, IN; Tina Wong, Grace + Ivory, Chicago, IL; Victoria Thomas, The Pink Tub LLC, Indianapolis, IN; Lyndy Bazile, Studio Vwazen, Fort Wayne, IN; Nicole Bijou, Nicki Rouge Bridal Team, Chicago, IL; Leeann Lynch, Lendistry COO – Photo credit: Tasha Peterson, Phoenix Media Photography

Women-Owned Businesses Win Grants at WNBA All-Star Weekend

Lendistry’s first ever Small Biz Shot Clock Contest awarded $16,000 to five business owners this summer in Indianapolis.

Learn more

Photo: Joe Kerwin, Lendistry CMO; Carol Podolak, BNutty, Portage, IN; Tina Wong, Grace + Ivory, Chicago, IL; Victoria Thomas, The Pink Tub LLC, Indianapolis, IN; Lyndy Bazile, Studio Vwazen, Fort Wayne, IN; Nicole Bijou, Nicki Rouge Bridal Team, Chicago, IL; Leeann Lynch, Lendistry COO – Photo credit: Tasha Peterson, Phoenix Media Photography

Government Relations

In 2025 we took a structured approach, reaching out to government representatives across the country.

We had 122 federal engagements and meetings with:

25 Senators and 97 Representatives

60 Republicans and 72 Democrats

40 states

Supporting Small Businesses Everywhere They Do Business

Miller Time Sportfishing

SBA 7(a) Loan

“If I had not secured this loan I would be out of business at this time. I had a catastrophic mechanical meltdown on my vessel and had to totally rebuild the boat… I did consider an SBA loan many years ago and gave up, but this process was a night and day difference.” – Troy Warren, owner

2’EAZY LLC

Relay Carrier Financing

“A lot of issues can come out of nowhere with truck maintenance that knock you off your shoes, but with this financing available, I didn’t have to choose between purchasing new trucks and fixing old ones. I didn’t believe opportunities like this could exist.” – Ellis Sandifer, owner

LS41 Cafe

Airport Concessions

“Even though we’re in a designated Opportunity Zone, no bank would touch us. None understood the airport business or wanted to learn. I met Everett and Rutger at Lendistry, and we spoke the same language from the start.” – Jorge Perez, owner

U.S. Black Chamber of Commerce

Commercial Real Estate

“When I reflect on the journey of the U.S. Black Chambers over the past 16 years, I see a story of resilience, vision, and progress. This campus is the next chapter of that story — not just a building, but a living symbol of what happens when we claim our space, own our future, and build institutions that outlast us.” – Ron Busby Sr., President & CEO of the U.S. Black Chambers, Inc.

Supporting Small Businesses Everywhere They Do Business

Miller Time Sportfishing

SBA 7(a) Loan

“If I had not secured this loan I would be out of business at this time. I had a catastrophic mechanical meltdown on my vessel and had to totally rebuild the boat… I did consider an SBA loan many years ago and gave up, but this process was a night and day difference.” – Troy Warren, owner

2’EAZY LLC

Relay Carrier Financing

“A lot of issues can come out of nowhere with truck maintenance that knock you off your shoes, but with this financing available, I didn’t have to choose between purchasing new trucks and fixing old ones. I didn’t believe opportunities like this could exist.” – Ellis Sandifer, owner

LS41 Cafe

Airport Concessions

“Even though we’re in a designated Opportunity Zone, no bank would touch us. None understood the airport business or wanted to learn. I met Everett and Rutger at Lendistry, and we spoke the same language from the start.” – Jorge Perez, owner

U.S. Black Chamber of Commerce

Commercial Real Estate

“When I reflect on the journey of the U.S. Black Chambers over the past 16 years, I see a story of resilience, vision, and progress. This campus is the next chapter of that story — not just a building, but a living symbol of what happens when we claim our space, own our future, and build institutions that outlast us.” – Ron Busby Sr., President & CEO of the U.S. Black Chambers, Inc.

Game Changing Capital with Lendistry Capital Partners

TD Community Development Corporation

$25MM anchor investment

Starbucks Coffee Company

$5MM investment

Exelon Community Impact Fund

$5MM investment

East West Bank Specialty Finance Group

$75MM credit facility

KeyBank Specialty Finance Group

$100MM credit facility with $400MM accordion

SBA Securitization

Investment-grade rating

Game Changing Capital with Lendistry Capital Partners

TD Community Development Corporation

$25MM anchor investment

Starbucks Coffee Company

$5MM investment

Exelon Community Impact Fund

$5MM investment

East West Bank Specialty Finance Group

$75MM credit facility

KeyBank Specialty Finance Group

$100MM credit facility with $400MM accordion

SBA Securitization

Investment-grade rating

Lendistry Launches Insurance Agency to Give Small Businesses a “LIFT”

“No one likes to think about insurance, but it’s one of those things business owners shouldn’t do without, especially when they have employees and loans to support. But just providing a connection isn’t enough-it should be easy for them to access online, after business hours. LIFT is our next step in becoming a trusted, one-stop partner for businesses, so they can protect what they’ve put so much heart and hard work into growing.”– Everett K. Sands

SBA Milestones in 2025

2025 SBA

Fiscal Year:

$384,789,600 loans

1,849 businesses

The Center by Lendistry: 2025

Stronger businesses. Stronger communities.

Climate Resilience | Household Recovery | Small Business Growth

As a nonprofit strategic partner to Lendistry, The Center by Lendistry supports diverse small businesses through education, technical assistance, and access to competitive financing. Their mission is to close the wealth gap by anchoring small businesses and the communities where they do business.

Resilience

Across the country, clean energy opportunities are reshaping how communities work, build, and grow. The Center launched the Main Street Goes Green Initiative to equip small businesses with tools to cut energy costs and strengthen their bottom line and help small contractors win bids in the clean energy economy.

Recovery

When disaster strikes, local economies depend on fast, fair, and community-centered recovery. This year, The Center partnered with LA County to deliver the Household Relief Grant Program for families impacted by the Eaton and Pacific Palisades fires. The program distributed $32M in critical finance assistance to help households stabilize and rebuild their lives.

Growth

Small businesses need tools that unlock new customers and new revenue. The Center’s Digital Growth Accelerator did exactly that, guiding entrepreneurs through hands-on digital training to help them strengthen their brand and upgrade their online presence. Participants gained practical skills, one-on-one coaching, and access to digital solutions that support their long-term growth.

Main Street Goes Green Accelerator

Empowers California small businesses with personalized guidance, practical tools, and ongoing support to reduce energy use and strengthen their bottom line.

Contractors Accelerator

B.U.I.L.D. Incubator

Beltline Business Ventures

Digital Growth Accelerator

A Trusted Partner for Small Businesses, 10 Years in the Making

©2026 B.S.D. Capital, Inc. dba Lendistry. All rights reserved. (https://www.nmlsconsumeraccess.org) Loans originated by B.S.D. Capital, Inc. dba Lendistry are made pursuant to state law and may not be available in all states. NMLS# 1945565. SBA loans originated by Lendistry SBLC, LLC, a wholly owned subsidiary of B.S.D. Capital, Inc. dba Lendistry. Lendistry SBLC, LLC is approved to offer SBA loan products under SBA’s 7(a) Lender Program. NMLS# 1571851.

California residents: Loans made or arranged pursuant to a California Finance Law license. B.S.D. Capital, Inc. dba Lendistry California Finance Lender, License #60DBO-66872. Lendistry SBLC, LLC California Finance Lender, License #60DBO-49327.